Matador Resources Company Announces Mallon Well Results

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170202006413/en/

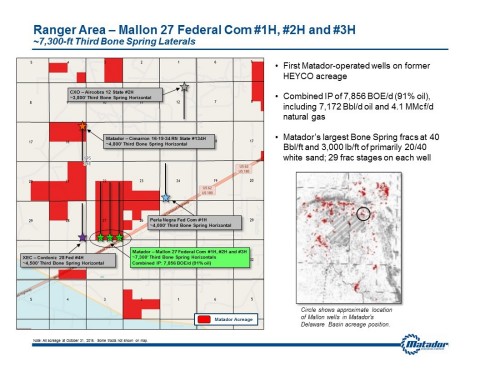

Diagram detailing the location of the Mallon wells. (Photo: Business Wire)

Mallon Well Results – Ranger Asset Area

Matador is pleased today to announce the 24-hour initial potential test

results from three recent completions in its Ranger asset area in

The 24-hour initial potential test results from each well are summarized in the table below.

| Initial Potential | |||||||||||||||

| Oil | Gas | BOE | % Oil | FCP(1) | Choke | ||||||||||

| Well | Interval | (Bbl/d) | (Mcf/d) | (BOE/d) | (psi) | (inch.) | |||||||||

| Mallon 27 Federal Com #1H | Third Bone Spring | 2,500 | 1,680 | 2,780 | 90% | 1,327 | 34/64" | ||||||||

| Mallon 27 Federal Com #2H | Third Bone Spring | 2,427 | 1,387 | 2,658 | 91% | 1,414 | 34/64" | ||||||||

| Mallon 27 Federal Com #3H | Third Bone Spring | 2,245 | 1,035 | 2,418 | 93% | 1,482 | 32/64" | ||||||||

| Total | 7,172 | 4,102 | 7,856 | 91% | |||||||||||

| (1) Flowing casing pressure. | |||||||||||||||

In aggregate, the three wells flowed 7,856 barrels of oil equivalent per day, consisting of 7,172 barrels of oil per day and 4.1 million cubic feet of natural gas per day (91% oil). Matador has just over a 70% working interest in each of the Mallon wells. Owing to a large portion of federal acreage comprising each unit, the Company’s royalty burden in each unit is approximately 18.5% (as opposed to up to 25% on typical fee leasehold), giving Matador an overall net revenue interest of approximately 58% in each of these wells. As Matador noted at the time of the HEYCO merger, the Company expects to benefit from lesser royalty burdens on wells drilled on the former HEYCO acreage.

Each of the three Mallon wells are 7,300-ft horizontal laterals, and each has a completed lateral length of approximately 7,000 ft. Each well was completed with a 29-stage fracture treatment, including approximately 40 barrels of fluid and 3,000 pounds of primarily 20/40 mesh white sand per lateral foot. These were the largest fracture treatments pumped to date by Matador in a Bone Spring completion.

The location of the Mallon wells is shown on the accompanying map. At

Management Comments

Joseph Wm. Foran, Matador’s Chairman and CEO, commented, “We are pleased

to announce the results of the Mallon wells, which are among the very

best wells Matador has drilled in the

About

Matador is an independent energy company engaged in the exploration,

development, production and acquisition of oil and natural gas resources

in

For more information, visit

Forward-Looking Statements

This press release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

“Forward-looking statements” are statements related to future, not past,

events. Forward-looking statements are based on current expectations and

include any statement that does not directly relate to a current or

historical fact. In this context, forward-looking statements often

address expected future business and financial performance, and often

contain words such as “could,” “believe,” “would,” “anticipate,”

“intend,” “estimate,” “expect,” “may,” “should,” “continue,” “plan,”

“predict,” “potential,” “project,” “hypothetical,” “forecasted” and

similar expressions that are intended to identify forward-looking

statements, although not all forward-looking statements contain such

identifying words. Actual results and future events could differ

materially from those anticipated in such statements, and such

forward-looking statements may not prove to be accurate. These

forward-looking statements involve certain risks and uncertainties,

including, but not limited to, the following risks related to financial

and operational performance: general economic conditions; the Company’s

ability to execute its business plan, including whether its drilling

program is successful; changes in oil, natural gas and natural gas

liquids prices and the demand for oil, natural gas and natural gas

liquids; its ability to replace reserves and efficiently develop current

reserves; costs of operations; delays and other difficulties related to

producing oil, natural gas and natural gas liquids; its ability to make

acquisitions on economically acceptable terms; its ability to integrate

acquisitions; availability of sufficient capital to execute its business

plan, including from future cash flows, increases in its borrowing base

and otherwise; weather and environmental conditions; and other important

factors which could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. For further

discussions of risks and uncertainties, you should refer to Matador’s

View source version on businesswire.com: http://www.businesswire.com/news/home/20170202006413/en/

Source:

Matador Resources Company

Mac Schmitz, 972-371-5225

Capital

Markets Coordinator

investors@matadorresources.com